Finance

2.10 Budgets (HL only)

Cost and profit centers

A business can prepare two types of budgets:

- For profit centers

- For cost centers

Cost centers

- A department in a business that generates costs but no revenue

- Responsible for its operational cost

- Can be organized by their function, product, or geography

- e.g., marketing and HR departments

Profit centers

- A department in a business that generates both revenue and costs

- Its contribution towards the whole business' profit can be determined

- Can be organized by their function, product, or geography

- e.g., retail stores (in a retail chain business)

Role of profit and cost centers

- Monitor and control business; business has more control over its operations and can monitor itself more effectively

- Enables benchmarking; improve financial performance

- Healthy motivation within departments to compete for performance

- Employees have a better sense of how much to allocate than managers who do not work at the site

- Accountability; makes managers and budget holders accountable for their actions

Limitation of profit and cost centers

- Loss of control from executives

- May cause unhealthy competition between departments

- May encourage managers to prioritize short-term results and thus not invest in the long term (e.g., staff training)

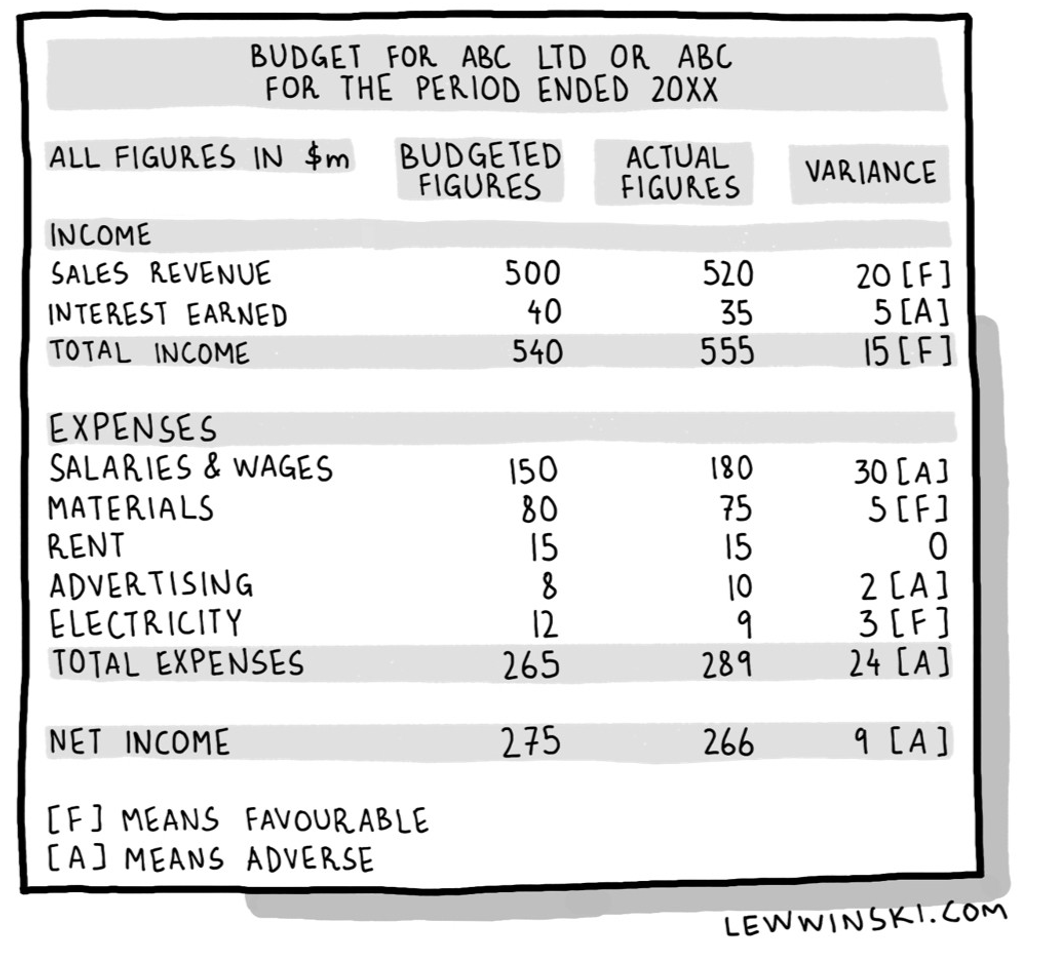

Constructing budgets

- A budget is a financial plan for the future usually involving the expected costs and revenue of a cash flow forecast for a determined period of time

- Helps a business achieve its objectives and plan for finances needed when implementing new strategies

- Structure:

Variance analysis

Compares the budgeted figure to the actual figure

- A stands for Adverse

- F stands for Favorable

- 0 is used for No Variance (when budgeted figure = actual figure)

It depends on perspective; If a cost increases it is Adverse but if sales revenue increases it is favorable

Exam tip

Remember to always write the title when constructing budgets as the IB will deduct points if you forget to do so.

Importance of budgeting and variance analysis

- Helps plan finances for operations

- Helps a business control its activities and decision making

- Helps gauge performance; ability to stay within budget

- Motivation; business can provide bonuses for departments who stay within budget

- Promotes internal coordination between departments