Introduction to Business Management

1.5 Growth and Evolution

Economies of scale

The fall in average cost of production as a firm increases in size. As output increases, total production costs rise but as the fixed costs of production are being spread over more units, the average cost decreases.

Internal economies of scale

Occur as a result of the growth in the scale of production within the business. Factors inside the business lead to lower average costs. Examples include:

- Purchasing economies of scale where large firms buy raw materials in bulk and receive discounts by doing so (lowering average cost).

- Marketing economies of scale where the cost of advertising is spread over a large number of products, thereby reducing average cost.

External economies of scale

Occurs due to external factors outside of the business. Examples include:

- Skilled labor supply increase which lowers the cost of skilled labor.

- Graphic Cluster which is when an industry grows and ancillary firms move closer to manufacturers to cut costs and induce more business.

Diseconomies of scale

Excessive growth of a firm's size that leads to inefficiencies and an increase in average cost of production.

Internal diseconomies of scale examples

- Loss of control and coordination; grows too large; lower productivity.

- Cockiness; reduces productivity as it leads to slackness.

- Paperwork increases as firm increases; time consuming + adds costs.

External diseconomies of scale examples

- Increasing market rents.

- Higher wages due to shortage of supply of skilled labor.

- Traffic: if businesses are all close together it increases transportation costs and is time-consuming.

How to measure size of a business:

- Total revenue in a year.

- Profit.

- Market share.

- Size of workforce.

- Capital employed.

- Market capitalization.

Growth of firms can be internal (organic) and external (inorganic).

Internal growth

Organic growth is when a business expands by its own efforts and operations.

External growth

Inorganic growth is growth achieved with support of partner organizations. One of the key reasons for inorganic growth over organic growth is that the growth of the business can be achieved quicker.

A merger is when 2 or more companies come together to form one brand new company. The 2 previous companies no longer exist as single businesses. The merged company combines their assets to grow and become competitive in the market.

A takeover is when one business purchases and owns another business. With the purchase they own all the assets and technology of the other business. In a takeover a company is not being formed as one business is simply acquiring another business without their previous "consent"/knowledge of it.

An acquisition is the same as a takeover but there is an agreement before the business is purchased.

Advantages of External Growth

- Immediate increase in revenue as the sales of both companies are combined.

- Economies of scale.

- Reduced competition.

- Larger customer base.

- Access to more resources.

Disadvantages of External Growth

- Authorities have the ability to limit this type of growth to prevent monopolies.

- Initial cost of takeover/acquisition is steep.

- Doesn't guarantee success; risky.

- Integrating 2 (or more) different corporate cultures can be difficult as companies have their own identities.

- Loss of control.

- May lead to diseconomies of scale.

Types of mergers takeovers and acquisitions

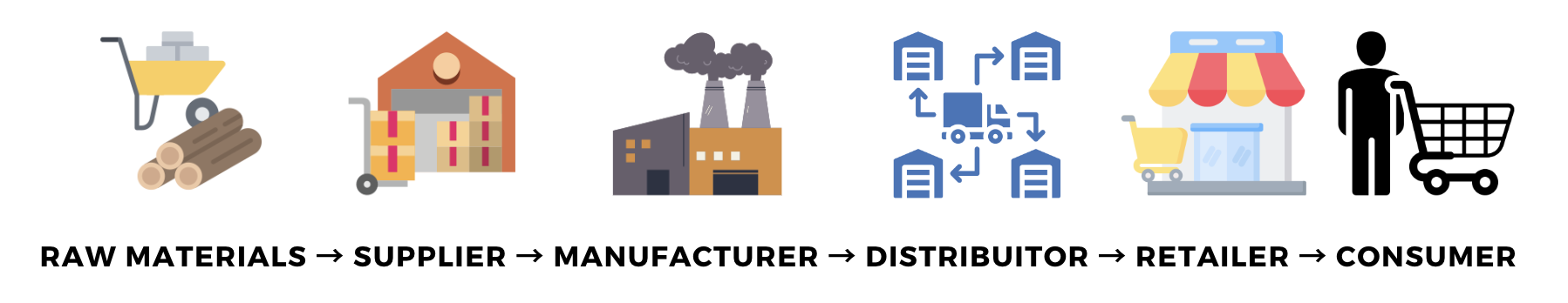

- Backward vertical integration: acquisition/takeover/merger with a firm earlier in the chain of production (e.g. An ice-cream retailer merges with an ice-cream manufacturer).

- Forward vertical integration: acquisition/takeover/merger with a firm forward in the chain of production (e.g. dairy farmers merging with ice-cream retailer).

- Horizontal integration: when businesses that operate in the same industry and is in the same stage of the chain of production come together either through a merger acquisition or takeover. The companies are likely competitors (e.g. ice-cream retailer business makes a takeover of another ice-cream retailer business).

Internal growth

Can be achieved two ways:

- New products: innovation and research and development of new products. Companies diversify their products and enhance their product range.

- New markets: expanding into new markets (e.g. overseas).

Advantages

- Less risky than external growth as you expand an already successful business.

- Maintain current corporate culture and ethics.

- Control the rate the business grows; can moderate the expansion rate.

- Avoids diseconomies of scale.

Disadvantages

- Slower growth as it takes time to develop new products and penetrate new markets.

- Miss on opportunities for growth.

- Takes time to adapt to changes (specifically to "New markets" approach).

- Access to finance is less limited than external growth.

Reasons to grow companies

- Economies of scale: cost efficiency.

- Market power: power to impose own prices.

- Shareholder returns: generate higher margins.

- Lower risk from hostile takeover bid due to increased price to place a bid.

- Manager objectives.

- Synergies through increased revenue streams.

- Customer loyalty.

- Brand recognition.

Reasons to stay small

- Ability to manage and control costs.

- Easier to manage finance.

- Lower financial risk.

- Government aid (to provide initial support).

- Closer relationship with consumer.

- Flexibility: adapt things to customers.

- Safe from large competitors.

- Can benefit from a niche market.

Other external growth methods

Joint Ventures

When 2 or more businesses split the costs, risks, control, and rewards of a business project; it lasts a specific amount of time: often long-term. They join to create a new business but their previous businesses continue to exist.

Advantages

- Synergy.

- Spreading costs and risks.

- Easier entry to foreign markets.

- Relatively cheap compared to takeovers.

- Reduce competition/increase competitiveness.

Disadvantages

- Both businesses have a say in decision making; possible conflicts.

- Reaching an agreement may require a lot of negotiation: time consuming.

- Sharing sensitive information can be a concern if businesses are competitors.

- Culture clash can lead to bad quality business.

Strategic alliances

Similar to joint ventures in the way they share costs, resources, and ideas but they do not create a new business. Each participating company retains its ownership and control allowing them to make their own decisions. Often vary in duration. Usually focused on a specific area for collaboration.

Franchising

Where a business (franchise) buys a license to trade using another firm's brand: name, logo, trademark, etc. In return, the purchaser of the license (franchisee) pays a license fee to the parent company.

Advantages

- Popular way to achieve rapid global growth.

- Franchisee normally sets up franchise with their own money saving the parent company the burden of funding the operation.

- Franchisees already possess knowledge on local market and culture.

- Motivated operators as their success relies on their performance.

- Brand visibility and recognition.

- Form customers worldwide (loyal).

Disadvantages

- Loss of control: may lead to variances in product standards and quality.

- Reputation is in risk: actions from franchisee impact the whole brand.

- Franchisor may be expected to aid franchisee: e.g. provide staff training.

- Lots of legal paperwork is required: time-consuming.

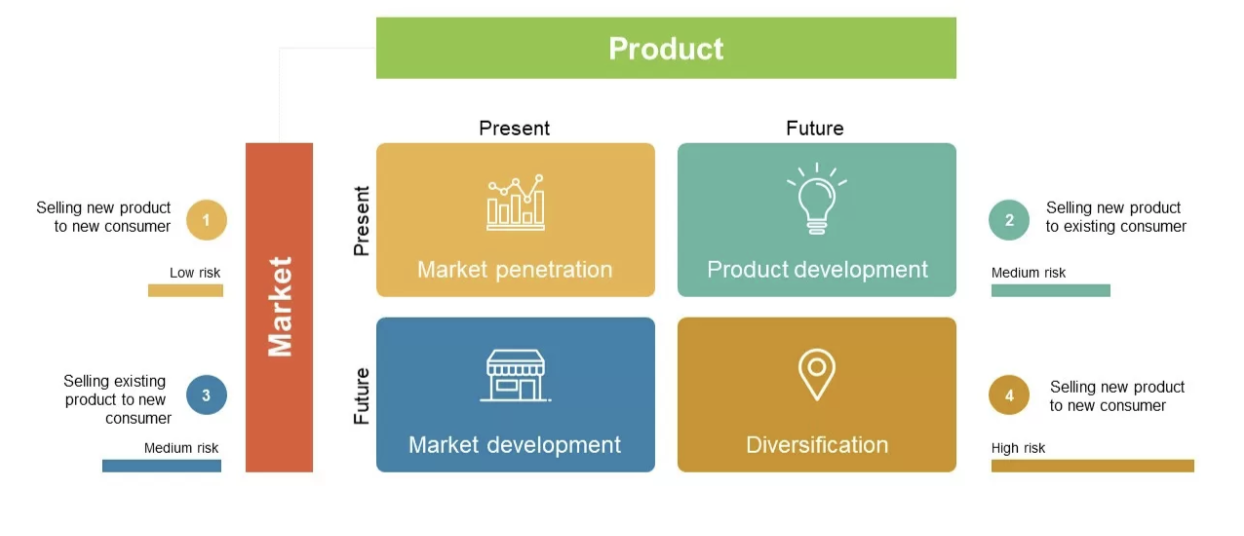

Tool: Ansoff Matrix

It is a tool for businesses who have a growth objective and want to grow. It is used to identify an appropriate corporate strategy and the level of risk associated with the chosen strategy. The tool considers the market (customers) and product.