Finance

2.9 Investment appraisal

They are tools used by companies to decide where to invest and where their money can provide better returns

Payback period tool

- The estimated time it would take for a business to make its money back from its initial investment

- See how many years it takes for accumulated net flow to reach 0

- Must divide the year in fractions if payback period is in the middle of a year

- Formula:

Advantage

- Simple method; easy to calculate and understand

- Useful in cases where businesses need to calculate when to buy a replacement

- Useful for cash flow problems

Disadvantage

- Provides no insight into profitability of investment

- It is all a forecast; can mislead businesses if not calculated correctly

- Doesn't consider the size of the investment; hard to compare them with each other

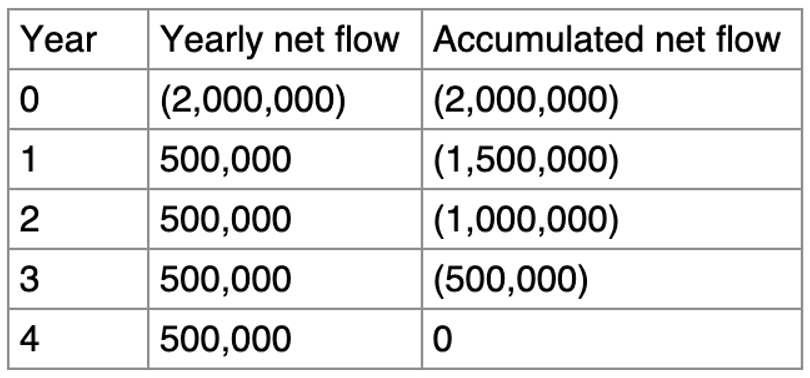

Example:

A project has an estimated cost of 2 million USD and is expected to result in an yearly net cash flow of 500000 USD. The payback period is 4 years: the amount of time it will take for the cumulative cash flow of the project to reach 0.

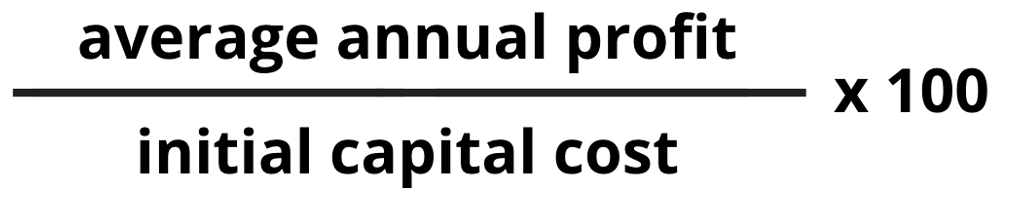

Average rate of return (ARR)

- Calculates the average annual profit of an investment expressed as a percentage of the initial amount of money invested in it

- Formula:

Advantages

- Easy to calculate and understand

- It focuses on profits rather than time

- Can be used to judge a firm's financial performance and evaluate different investment strategies

Disadvantages

- Does not consider inflation

- The figures used are only estimates so it must be treated with caution; the longer the investment analyzed the less accurate it is

NPV (HL)

- It is a financial metric that calculates the difference between the present value of cash inflows and outflows of an investment helping determine its profitability

- To be able to compare values we must use a present value calculation. We do so by multiplying the expected value in the future by a discount factor to get the "present" value of the future money

Advantage

- Greater forecasting ability as its more accurate due to consideration of inflation

Disadvantage

- Forecasting two values: inflation and cash inflow

Discount table example:

Exam tip

Note that you are given discount tables in exams so there is no need to worry about memorizing stuff.