Finance

2.5 Final accounts

Final accounts are the published accounts of an organization made available to and used by different stakeholders. The final accounts of a business consists of two important sets of financial statements:

- The profit and loss account (also known as income statement)

- The balance sheet (also known as statement of financial position)

Internal stakeholders include managers, employees, and shareholders. They can use the final accounts to measure the performance of the business in order to negotiate better pay deals or assess level of job security.

External stakeholders include banks, suppliers, customers, and the government. They are interested in an organization's final accounts in order to enable them to make sensible and logical decisions; e.g., financiers (banks) evaluate the organization's ability to afford its debts.

Why are they interested?

- Managers

- Measure business performance against targets and competitors

- Information important for decision-making

- Control the revenues/expenses from each department of the business

- Set SMART objectives

- Shareholders

- Interested as they want to track the financial performance of the company they own. This can provide them with information to help them decide whether to buy, hold, or sell their shares.

- Calculate the return of their investment

- Determine how much dividends they will receive

- Predict whether the organization will grow and expand

- Employees

- Measure whether their job is secure and possible promotional opportunities (if high profits, the job security is likely higher)

- Employees can use financial accounts as leverage and arguments when asking for a raise and possibly better working conditions

- Financiers

- Assess the level of risk associated with loaning money to the business to determine whether or not it is a suitable decision for the bank

- Suppliers

- Use as an indicator to know the quantity of trade credit to allow for a business

- Use to negotiate credit terms with business

- To see if the business is growing a lot which may dictate/influence the production of the suppliers

- Government

- To calculate the amount of taxes that a business needs to pay

- To verify if the business is paying the correct amount of taxes

- To measure the extent to which a company can expand and create jobs in the economy

- To ensure the business operates within the law; use the country's accounting laws

- Competitors

- Allow the company to compare their operations and success with the other company's success

- Customers

- Determine whether a business is financially secure

- Determine if the business offers security and reliability in its services

- Determine whether there will be future supplies of the product they are purchasing

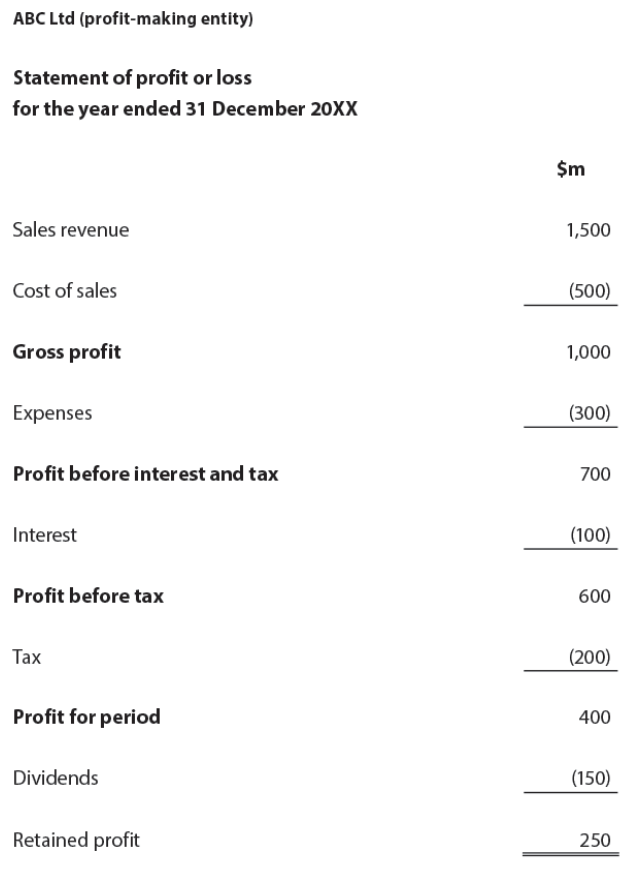

Profit and loss account

- Shows the profit or loss results from a business' operations

The following template is given by the IB business guide:

First we need to know and understand how each value is calculated:

- Revenue = quantity x price

- Gross profit = revenue - direct costs

- Profit before interest and tax (also called operating profit) = Gross profit - indirect costs

- Profit before tax = Net profit - interest

- Profit after tax = Dividends + Retained profit

Note that the values being deducted are surrounded by brackets indicating that it is a cost which the business must pay.

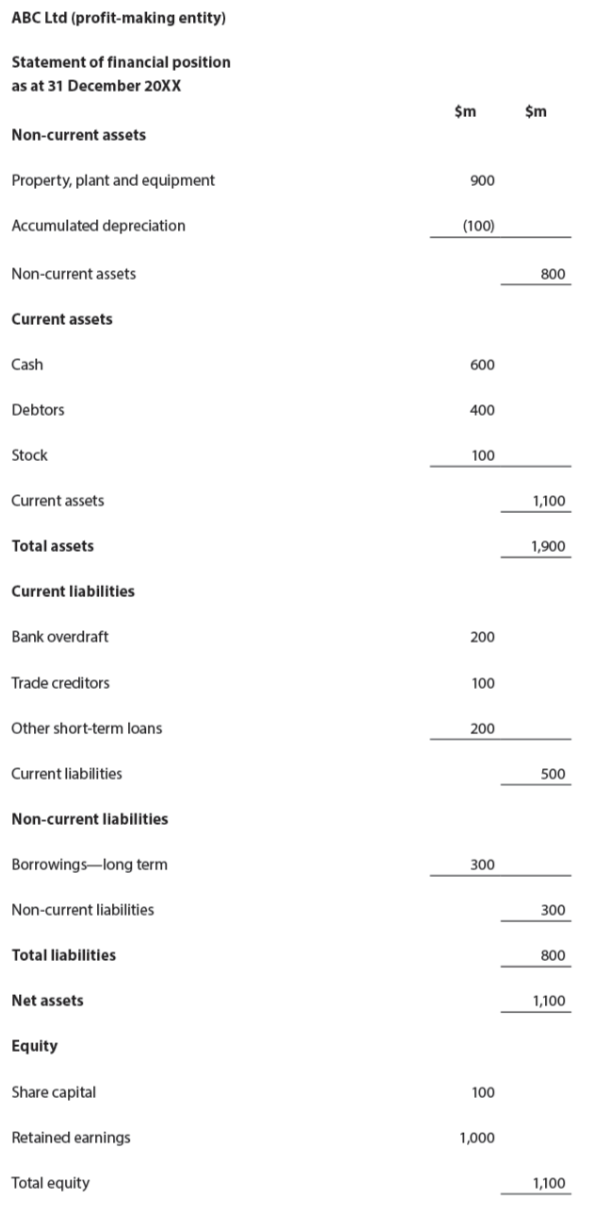

Balance Sheet

- A balance sheet represents a quick financial picture of the company at a given moment in time. It shows the company's assets and the company's liabilities.

- The balance in the balance sheet comes from the fact that Assets need to necessarily equal liabilities + equity.

The following template is given by the IB business guide:

- Non-current (fixed) assets: Assets to be kept and used by the business for more than one year

- Current assets: Assets that are likely to be turned into cash (liquidated) before the next balance sheet date

- Inventories: Stocks held by the business in the form of materials, work in progress, and finished goods

- Debtors: People who owe the business money who have bought goods on credits

- Current Liabilities: debts of the business that will usually have to be paid within one year

- Creditors: People who the business owes money bought on credit payable to suppliers

- Overdraft: externals source of finance (Discussed on subtopic 2.2)

- Non-current liabilities: value of debts of the business that will be payable after more than one year

Exam Tip

To memorize the balance sheet's structure use the sandwich method. The bread (outside) is composed of non-current assets and liabilities and the filling of current assets and liabilities. Here is the example:

TITLE (Balance sheet for <company XYZ> as of <date>)

NCA

CA

CL

NCL

EQ

Intangible assets:

If they appear in the balance sheet they might show up as "intangible assets" and are treated as fixed assets. Here are the examples you need to know:

- Copyrights: Protect original works of authorship such as literary, artistic, and musical creations. They give the creator exclusive rights to reproduce, distribute, and display their work.

- Trademarks: Symbols, names, or words that distinguish and identify the source of goods or services (identity of company). They protect brands and help consumers identify and differentiate products in the marketplace.

- Brand: Combination of a company's name, logo, design, and other visual elements that create a unique identity for its products or services. It represents the company's reputation and helps establish customer loyalty.

- Patent: Legal protection granted to businesses for their new inventions. It gives the inventor exclusive rights to make, use, and sell the invention for a limited time. A license of patent can be authorized by the owner for a royalty on the products.

Depreciation

- The fall in value of a non-current asset over time

- Can be due to wear and tear or new competing technology being introduced to the market

- It is shown in the profit and loss as an expense and on the balance sheet to accurately reflect the asset's "true" value

- Scrap value = value of an asset at the end of its useful life

- There are 2 methods of measuring depreciation:

- Straight line

- Units of production

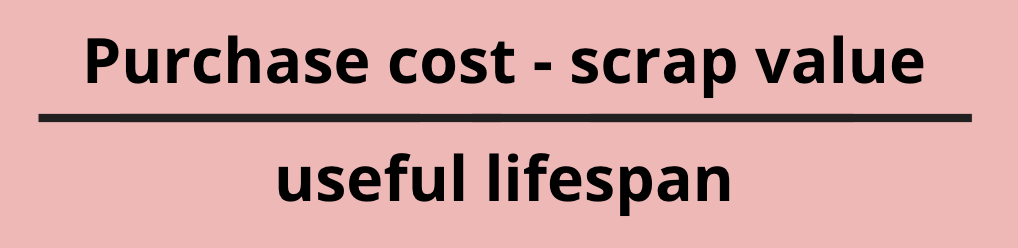

Straight line method:

- You deduct a constant amount from the balance sheet value of the asset every year throughout its estimated life (time it takes for asset to reach scrap value)

- Formula to find the true/depreciated value of asset:

Advantages:

- Ease of calculating; very straight forward method is deducted every year

- Suitable for assets with consistent usage overtime or with known useful span

Disadvantages:

- Several non-current assets depreciate irregularly so this method is not suitable for all assets and may provide inaccurate representation of their value; e.g. cars depreciate a lot at their initial stages

- Many assets do not depreciate consistently as they become less efficient over time (e.g. machines)

Units of production

- Calculates an asset's depreciation based on usage (units produced)

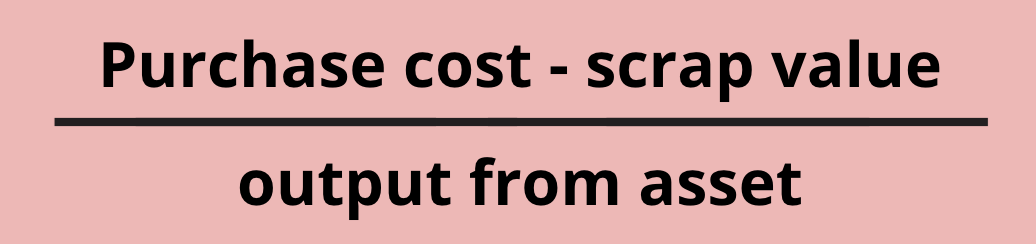

- Formula to find depreciation rate per unit:

Advantages

- Suitable for assets that depreciate as they are used: e.g. machinery

- Useful for businesses who experience fluctuations in production

Disadvantages

- More complicated to calculate than straight line method

- There are other factors that influence the depreciation of the asset which are not taken into account

- Does not apply for assets which are not directly used in production (e.g. furniture)