Finance

2.8 Cash flow

Definition

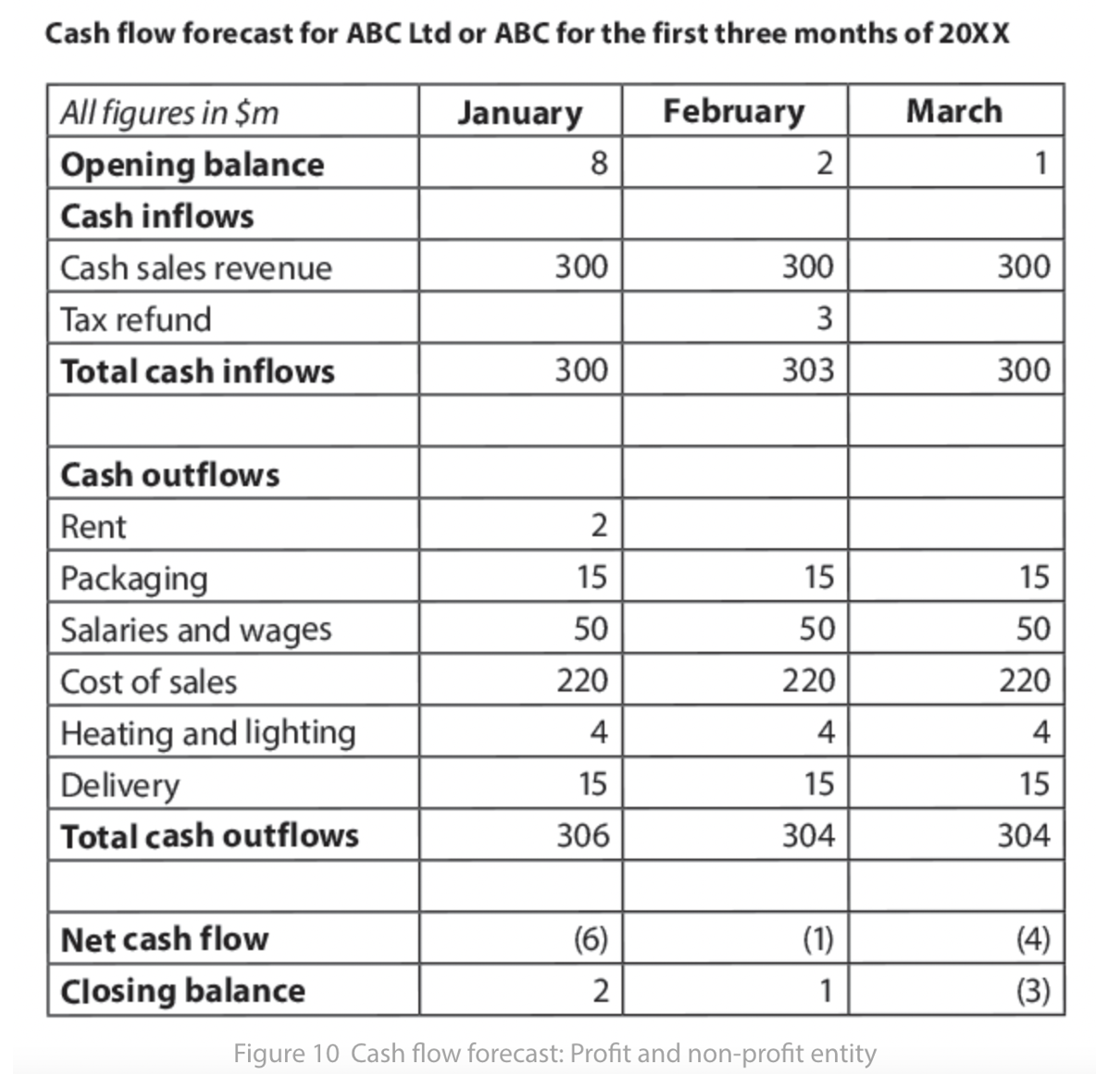

- The payments received by a business (inflow) and payments made by a business (outflow)

- Cash flow is different to profit as profitable businesses can still face liquidity problems. Cash is not necessarily received immediately when bought with trade credit so it is not considered an inflow but it is considered as revenue when calculating profit

Forecast

- Used to predict how cash is likely to flow into and out of a business for a specific period of time

- Helps avoid liquidity problems

Structure provided by the IB:

Relationship between profit investment and cash flow

- Investments often require large down payments leading to a negative impact on cash flow however it should help cash flow on the long run

- At the early stages of a business the investment is significant but profit is minimal and cashflow is negative; as it grows this changes

Strategies to improve cash flow

- Cash flow problems occur when a business has insufficient funds to fund its operations

- There are 3 ways of improving:

- Reduce cash outflows (e.g. improve credit terms with suppliers)

- Increase cash inflows (e.g. reduce credit period of debtors)

- Find source of finance (e.g. overdraft)